Something really important happened this past week. Something that will affect everyone, globally.

On Wednesday September 18th, the Federal Reserve (Fed) in the USA pivoted on interest rates and lowered interest rates by 0.5%.

I’m embarrassed to say that I did an MBA with Finance Major and honestly never really understood the full impact of interest rates back then.

I now understand the impact of interest rates (and money printing).

Lower rates mean cheaper and easier borrowing. I spoke of this and its effects in my previous article linked immediately below.

I won’t rehash all that, but the Fed just chose to avoid recession and unemployment over getting inflation under control. I don’t blame them and I’m not sure I would make a different decision in their circumstances.

Rates are Coming Down, What’s Next?

Lower interest rates mean easier access to new debt.

New debt creation means expansion of the monetary system.

Remember, new debt, for the most part, doesn’t come from the existing monetary base, it comes from new money.

I started with a bold statement: Something that will affect everyone, globally.

Why, how?

Simply said (though now that I’m rereading this, it doesn’t look that simple 😂):

lower rates = new debt creation = expansion of the money supply = increased global liquidity = debasement of existing money = higher inflation = theft of your wages and saving = lower purchasing power = further destruction of the middle class = more haves, more have nots = more money chasing fewer scarce assets = prices of scarce, hard assets ripping higher.

The Bottom Is In

I lost a lot of money in 2008/2009 Great Financial Crisis (GFC).

I got freaked out and took to the sidelines.

I totally missed what “Quantitative Easing” meant and it took me years to finally understand it. 🤦♂️

Quantitative Easing meant that the Fed was lowering interest rates and increasing the monetary supply to bail out all of the private debt (banks, automotive industry, etc.) that had gone bad.

Through Quantitative Easing they effectively nationalized the private debt.

The “private debt” became “public debt”.

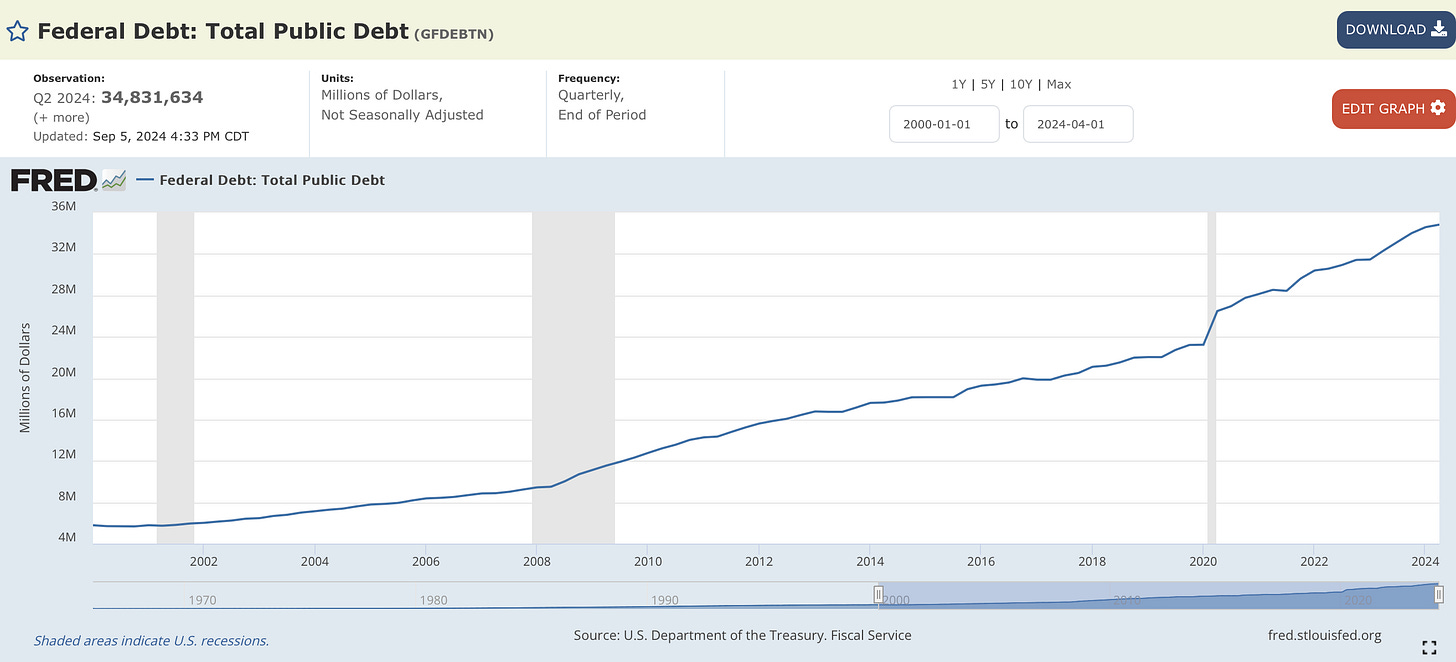

The private debt became public debt and we witnessed US public debt expand from $8T in 2008 to over $35T today.

$27 trillion dollar increase in just 16 years.

The US debt increased by 350% over 16 years. And if you are thinking, oh but I’m in Canada… well turns out that Canada is even worse!

Aside: here is a fascinating (and sad) link to the US National Debt Clock where you can watch the debt expansion in real time.

I was a value investor in 2008 and super focused on company fundamentals and

I didn’t yet understand the impact of global liquidity (global money printing) on stock and asset prices.

They printed massive amounts of new money again after March 2020 - I’m pretty sure everyone realizes that now and the inflation on the price of every desirable thing.

Well the money printing just began again last Wednesday.

If want to go deep on all of this, follow Tom Karadza on X or even join his real estate and Bitcoin coaching group for amazing content and insights (I’ve been a follower and member for years). Tom was the person who woke me up to all of this!!

When Tom says “spark another wave of inflation”, he means that the price of every scarce, desirable thing is about to go up.

As I said in my previous article referenced above,

Everyone today can feel that all scarce, desirable things like housing, quality food, energy, health care, education getting more and more expensive each day.

The bottom is in, it’s about to get worse.

Gold, real estate, the stock market, the price of meat, energy, health care, etc… and of course, Bitcoin, are all going higher from here.

BlackRock Report: Bitcoin, A Unique Diversifier

Don’t believe me?

Let’s checkout what BlackRock, the world’s largest asset manager, had to say in a report they released on Bitcoin earlier this week.

The highlights:

BlackRock recognizes Bitcoin’s value as a portfolio diversifier.

BlackRock’s Bitcoin ETF already has $21B in assets under management, making it, by far, the most successful ETF launch in history. For any firm, any asset, anywhere, ever.

Larry Fink, BlackRock CEO, admitted he was wrong to dismiss Bitcoin and is now a supporter.

BlackRock is the proxy for institutional investing in America and globally.

There is a massive wave of institutional Bitcoin buying that will come over the next 24 months.

Front Running the News

By understanding what is happening and tracking liquidity, we now have an opportunity to front run things.

Here’s what I’m doing…

I just made my first real estate purchase since 2020 and it closes in a few weeks, in early October.

I’m also looking at a couple of other real estate projects to start in early to mid-2025.

As far as Bitcoin goes, the start of a liquidity and money printing cycle is adding jet fuel to the Bitcoin fire. 🔥🔥🔥

Many people in the world can’t buy real estate either due to lack of downpayment funds, lack of access to mortgage banking or they live somewhere that lacks personal property rights.

Not everyone can open a stock trading account and buy Apple or Nvidia stock.

However, regardless of where you live in the world and how much money you have, with a smartphone and $100, you can start buying and saving in Bitcoin.

Wisdom From Satoshi

I’ll leave you with three quotes from the pseudonymous creator of Bitcoin, Satoshi Nakamoto:

#1. Satoshi embedded the below message in the Genesis block which was the headline from the British Sunday Times. I include this because “Second Bailout for Banks” was the shift of private debt to public debt in 2009 in the heart of the GFC. These were the days of “quantitative easing”. Well the Fed just pivoted to lower rates again on Tuesday so it’s a good throwback…

“The Times 03/Jan/2009 Chancellor on Brink of Second Bailout for Banks.”

#2. Satoshi rightly predicted that Bitcoin’s adoption in 20 years would be binary. It would either work on a large scale or it would fail miserably. Similarly on the value of Bitcoin, it will either be worth A LOT, like $1M+ per coin, or it will be worth zero. Well folks, in four more years Bitcoin will turn 20 years old…

“I'm sure that in 20 years there will either be very large transaction volume or no volume.”

#3 Every day the evidence (like BlackRock report!!!!) grows clearer that it might just catch on.

“It might make sense just to get some in case it catches on.”

So if you are sitting on the sidelines “waiting for lower prices”… I personally would STOP WAITING.

THE BOTTOM IS IN.

The rate cutting cycle just began which means that hard, scarce asset prices are headed higher.

I hope this helps educate and protect you and your family from what’s about to happen next. 💕💕

To Your Bigger Things,

Brad 💕👊

You are receiving The Bigger Things Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial, accounting or legal advice. Do your own research, come to your own conclusions and make your own decisions.

I haven’t gotten my head around the apparent collision course that energy hungry bitcoin has with the need to clean up our limited capacity energy sector. Is it still a requirement to mine more bitcoin? And how does that compare with printing more money?

Too bearish! Just kidding.

Not to get too personal, but with real estate prices falling dramatically against Bitcoin for the last number of years: what went into the decision into increase RE holdings vs. increased stacking?