An Entrepreneur's 8 Step Guide to Finance

How an Entrepreneur, not an Accountant, Lawyer or Financial Planner, thinks about money, business, investing and taxes...

As a business consultant to many small and medium size businesses over the past 15 years, I have come to see their inner workings, structures and finances. Through those experiences, combined with just generally being a finance geek, as well as a lot of trail and error,

Most entrepreneurs have a significant opportunity to optimize their financial, legal, and tax structure.

I get a lot of questions from clients and friends on elements of this so I thought I would put it together in a comprehensive way.

Here’s how I think about financial, legal and tax structure.

It all starts with…

1. Spend Less Than You Make

When I was meeting with my first accountant years and years ago and I was asking about complex business structures, he quipped “Brad, you are making all of this way too complicated. All you need to do if you want to have a lot of money is #1. spend less than you make. And #2 stay married to your first wife”.

Every financial program is going to start with the same first step… spend less than you make.

In our personal lives, that means having a money left over at the end of the month. In business, that means turning a profit. If we don’t have money left over or turn a profit, the rest of this is pretty pointless.

They say that…

what get’s measured gets managed.

In our personal lives the way we measure or finances is through a personal budget. Various budgeting programs are out there, on the personal side, I found Dave Ramsey’s 7 Baby Steps to be very useful.

In business, income and expenses are measured with an Income Statement or a Profit & Loss Statement.

Now that we can see money coming in and money going out, here are my tips to maximizing the surplus/profit:

At risk of stating the obvious - make the most money possible. I think we can overlook this one and fixate on expense reduction. But nothing makes this easier than finding ways to increase our income or add additional sources of income.

Reduce expenses as much as possible. This one isn’t fun, but can be necessary.

Making more and spending less results in the maximum surplus possible or the maximum profit possible.

Now that we have a surplus or are turning a profit, things start to get interesting…

2. Take Inventory of What You Have and What You Owe

If you made it past step one, and MONEY IN is greater than the MONEY OUT, congratulations! You have a surplus of funds, now what?

We need to measure our assets and liabilities.

We do so through the creation of a net worth statement (net worth is the term typically used for us personally) and balance sheet (the term typically used for business). A net worth statement and balance sheet are the same thing.

Now we want to measure our net worth.

When we facilitate Succession Planning with business owner clients, we start by having them complete the Family Inventory of Assets & Liabilities. I’ve provide a free download immediately below:

The “inventory” then provides the raw material for creation of a net worth statement.

3. Understanding Your Net Worth

The net worth statement provides the complete picture of all assets and all liabilities.

NET WORTH = TOTAL ASSETS - TOTAL LIABILITIES

There are all sort of net worth statement templates out there or you can just create your own with a very simple spreadsheet. I’ve provided a sample template below that you can download for free:

4. Understanding Entity Structure

If you own a business(es), considering how things are owned and structured from a legal standpoint is very important.

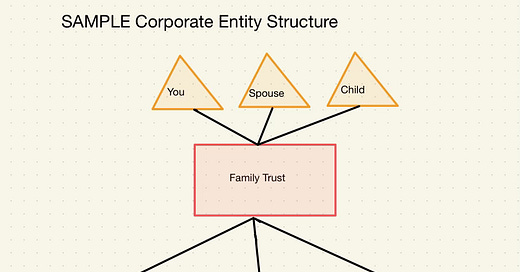

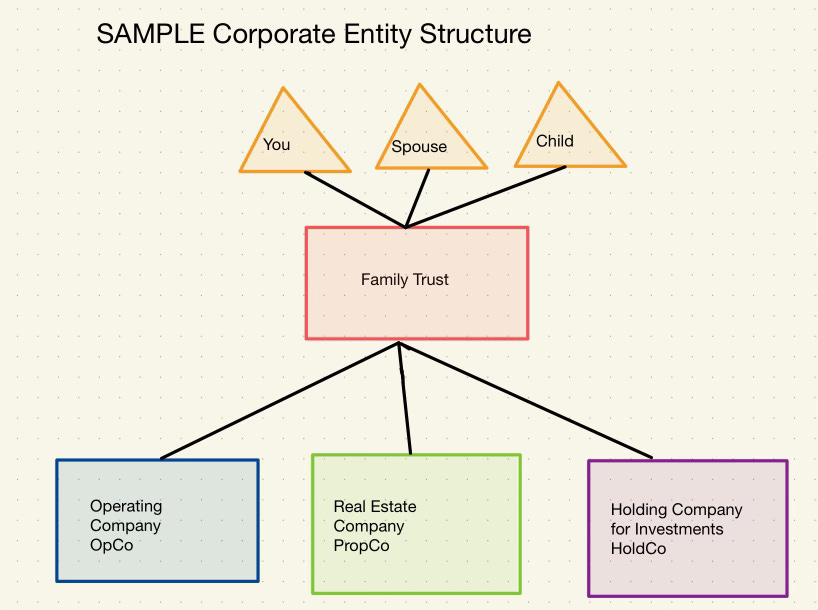

To understand entity structure, it is best to just draw a simple graphic that includes all of your legal business entities. The lines that link the entities clarify who or what owns each entity. See simple example below.

This should include any and all:

Family Trust(s)

Operating Company(s)

Real Estate Company(s)

Holding Company(s)

5. Clarify How The Money Flows?

Now that your entity structure is clear, clarify who is getting paid what. This includes:

Companies paying your other companies

Payments to you in the form of salary, expense reimbursements or dividends

Payments to your spouse and to your children in the form of salary, expense reimbursements or dividends

6. Key Considerations

Now that your financial and legal picture is becoming clearer, here are various considerations, in no particular order:

Corporate tax in Ontario, Canada is ~11% (for up to $500k) and top marginal tax rate personally in Ontario is 53.5%. So that means if we leave money in a corporation to invest, we can invest $.89 cent dollars ($1.00 less 11% tax). If we pay ourselves personally and are at top tax rate, we will be investing $.465 cent dollars ($1.00 less 53.5% tax).

Most people have personal debt on a home and are also making personal investments. Personal debt on a home (mortgage or HELOC) is not tax deductible (in Canada, though it is tax deductible in the USA). Borrowing money to invest, is tax deductible. So we should payoff or accelerate payment of all personal debt and the borrow it back for making the personal investment. This is officially called the Smith Manoeuvre and a simple example as follows:

We pay $1,000 per month on our mortgage (non-tax deductible)

We make a $300 per month personal investment in a stock trading account (non-tax deductible)

Instead we should pay $1,300 toward our mortgage and then borrow back $300 for investing via a HELOC. It has the exact same result, the same amount of debt except the interest on the $300 is now tax deductible.

Beyond just the Smith Manoeuvre, if you own a business, you should be looking at the strategic use of debt for investing. For example, is it better to pay $.11 tax and leave the money in the corporation and then borrow money personally to fund personal expenses? Not all liabilities are bad, it depends on what they are used for and what assets the debt is enabling.

Income balancing across your corporations. It’s important to look at ownership and contribution of various family members and ensure that fair amounts are being paid to all.

If you own a corp then you can likely control your income. And top marginal tax rate in Ontario is 53.5%. I find people really under-utilize their tax free savings accounts (TFSA). In my opinion TFSAs should hold your best and most aggressive investing idea such that you maximize tax free money through the gains. With that said, any capital loss in a TFSA is not tax deductible, so that’s the argument against.

If you and your spouse have “lumpy income” from year to year or if you have a spouse that doesn’t work or a spouse with considerably less income than you, you should be using Spousal RRSPs. Stop thinking about RRSPs as only something that you’ll cash out at 70 year old plus, it can be a very valuable tool for arbitraging tax rates or creating income in non or low income years.

7. You Need a Balance Sheet Strategy

If you’ve read this far, I’ll assume you have a strong balance sheet (more assets than liabilities).

As I talked about previously, we are living through an era of destruction of our wages, savings and ultimately our money. It is getting harder and harder for your wage growth to keep pace with inflation. Read my full article on this below:

Your wage growth can’t keep up to true inflation, so it is critical that you have a balance sheet strategy.

What I mean is you need to be strategic about the assets you own as well strategic about the liabilities you have and owe.

My personal investing strategy is:

Be Short Fiat, Be Long Hard, Scarce, Uncorrelated Assets

What does this mean?

The first part of my strategy is to “Be Short Fiat”:

“Fiat” means a currency (dollars) that are not backed by anything physical like gold.

“Short” means to borrow so to be “short fiat” means to borrow dollars (Canadian or American dollars).

With the current government debt loads it is a mathematical impossibility to ever pay back the debt.

To pay the interest on the government debt requires that additional dollar units must be printed.

That in turn means the dollar will debase further or be of even less value (we’ll see this through further inflation - dollars buy less and less or things cost more and more).

My strategy is to be “short fiat” which means I “borrow dollars”.

The second part of my strategy is to“Be long hard, scarce, uncorrelated assets”:

To be “long” means that you own something.

To be “long Apple stock” means that you own Apple stock.

“Hard, scarce assets”means things like quality real estate, Bitcoin, gold, silver, fine art, collectibles.

“Uncorrelated” means owning multiple assets where the movement of one doesn’t affect or isn’t related to the movement of another.

My strategy is to be “long hard, scarce, uncorrelated assets” which for me is to “own (and used borrowed dollars to own) a private company, real estate and Bitcoin (Bitcoin, Bitcoin ETFs, Bitcoin related stocks)”.

8. Get Strategic and There is No Need to Break The Law

I often hear about tax breaks and tax schemes people are using that border on very grey and quite possibly illegal.

I never understand why people push the limits so far when

the tax rules are actually quite fair.

In my experience people lack understanding of the rules and therefore make bad and unnecessary decisions:

People want all of these “deductions” but in reality have poor “net income”.

They don’t understand the tax rates.

They aren’t leveraging the fact that corporate tax rate is 11%.

They haven’t maxed out their TFSAs.

They haven’t done the Smith Manoeuvre.

They don’t under the deductibility of certain things.

I would encourage you to go through the steps I’ve outlined.

Get this all mapped out and then meet with your financial planner, lawyer and accountant and see what opportunities exist to maximize your structure, taxes and ultimately your finances.

I hope this helps you achieve your Bigger Things!

Brad 💕👊

You are receiving The Bigger Things Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial, accounting or legal advice. Do your own research, come to your own conclusions and make your own decisions.