Time is Running Out

The top 8 reasons why Bitcoin is going to $1M a coin

This past weekend, we made the boys (and dog) go on our annual Christmas tree hunt to cut down the perfect Christmas tree.

This is an annual family tradition where we all load up in the truck, hunt around the Christmas tree far, and all need to be in consensus about the “perfect tree”.

We were delighted to have some snow on the ground to make the event even more festive.

We found an 8 foot beauty and Candace spent Sunday afternoon decorating with Christmas music playing in the background.

In a previous article, I wrote about the value of family traditions…

as much as my kids roll their eyes at our traditions, they also love them because,

Our traditions solidify our family culture.

Our traditions clarify who we are as a family.

Our traditions highlight what is truly important to us.

Our traditions highlight that - family is everything.

I was at a work conference this past week and many people came up to me saying “hey I should have invested in Bitcoin at $15k USD when you kept saying it would go over $100k USD… and it’s now over $100k”.

My response to all of them:

“you haven’t missed anything, Bitcoin is going to $1M USD per Bitcoin”.

In response to that, a good friend asked me, “Brad, why do you keep saying such crazy stuff, how are you certain and why are you risking your reputation on this?”

Great question!

The short answer is that I’m pissed off that so many of my friends, family and colleagues are being stolen from in an unfair system.

This is my battle to fight.

People are being stolen from? What am I talking about?

This all starts with “what is money?”.

Money is an abstraction of our time and energy.

We go to work and get paid “money” in exchange for our time, effort and value we bring to the world.

Then governments, at will, print more monetary units into the system which devalues the money that we have earned and saved.

Think of it this way… you worked for 30 years, you gave your time and energy for 30 years. You went to work, 8am to 5pm, 5 days a week for 30 years. Then on a whim the government prints 40% new money into the system (like they did in March 2020) and they instantly STEAL MORE THAN A DECADE OF OUR TIME, ENERGY… OUR LIFE!

And that really pisses me off.

If only it was that mild. In Canada, new money creation (M2), new money printing has increased currency in supply by 480%!! 🤯

Everyone can “sense” that this theft happening but can’t really put their finger on the cause… or the solution.

Virtually everyone today understands that you can’t hold your wealth in cash or bonds as it doesn’t keep up to the rate of inflation … devaluation of your money via money printing.

Ultimately we need a place to store our wealth where:

it can not be arbitrarily printed away because it has a fixed supply,

it is totally secure, and

no one can control it or change it.

Well that would describe Bitcoin.

Yes I’m willing to risk my reputation because:

People need a bridge. A bridge from a system that steals your time and energy over to system that not only protects your time and energy but actually give that back to you. Crossing that bridge is transformative and life changing.

For those who crossed the bridge when Bitcoin was at $15k USD, it has already been life changing for many of them.

As I said, “you haven’t missed anything, Bitcoin is going to $1M USD per Bitcoin”. There is still time to cross the bridge but things are evolving quickly.

Here are my top 8 reasons why Bitcoin is going to $1M USD a coin (eventually):

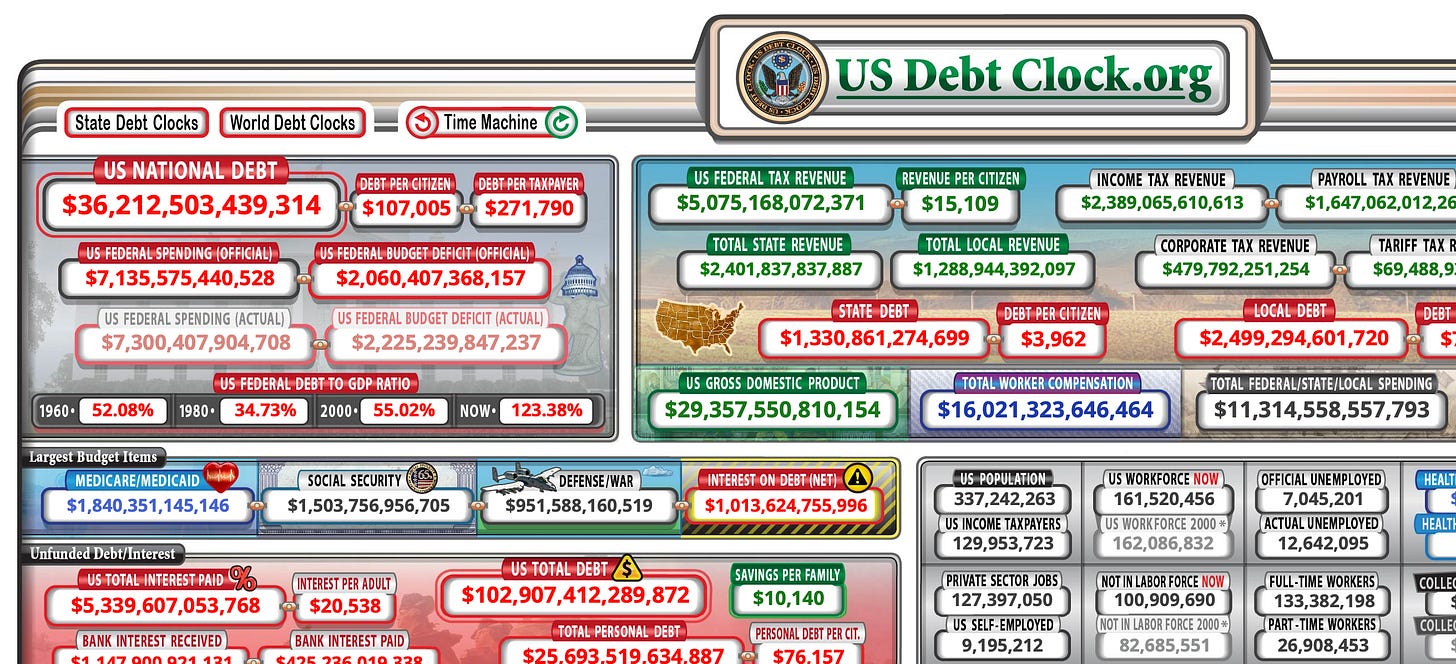

Printers gonna Print - The money printing will continue, the theft of your time and energy will continue. Click on the US Debt Clock.org image below and watch the money printing in real time. Wild!

Regulatory Tailwinds – for the past 16 years, Bitcoin has faced significant regulatory headwinds, yet here we are.

Governments, regulators and banks worldwide either completely banned Bitcoin or just made it difficult to use the “on and off ramps”.

That is all changing, and fast!

Trump has appointed Paul Atkins as SEC Chairman , Scott Bessent as Treasury Secretary, Howard Lutnick as Commerce Secretary. All of them are very pro-Bitcoin, with Lutnick personally holding hundreds of millions of dollars in Bitcoin.

Morocco banned Bitcoin in 2017 but announced a month ago, in November 2024, that it will now be legal again.

After years of trying to ban Bitcoin, a Chinese court recently ruled that owning Bitcoin is not against Chinese law, providing regulatory clarity.

We’ve been rowing into a 25 mile per hour headwind… the wind just shifted dramatically and is now a 25 mile per hour tail wind. Raise the spinnaker!

Still in the “First Inning” – Other than the people I’ve helped understand Bitcoin, I only know one guy investing in Bitcoin. One, that’s it.

I doubt you know anyone (other than crazy Brad 🤣) that has any sizeable investment in Bitcoin (excluding having a crypto wallet with a few grand worth of Bitcoin and Shitcoins).

With such little retail adoption, this tells me we are still so early when we are already at $100k USD and virtually no one we know is investing in the asset.

Adoption is still no where yet look at the price. Super bullish!

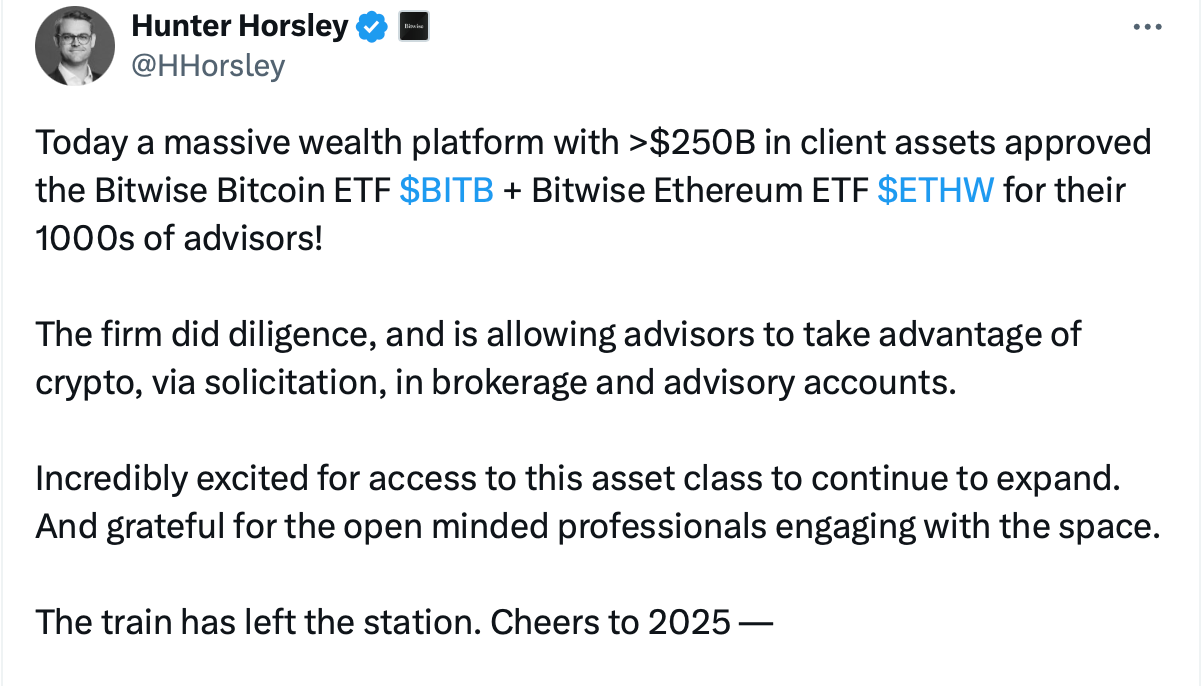

Financial Advisors – There are essentially two groups of financial advisors at this point. One group can’t even buy it if they wanted to as the company they work for doesn’t allow it.

The second group just hasn’t done the work to study it, is against it or isn’t aware of what Bitcoin is. I’m not aware of any Financial Advisors actually recommending and making an allocation for clients.

That’s all changing!

Bond Market Adoption – Bond investors have been losing purchasing power against true inflation for decades now. The bond market is $300 trillion dollars of dead capital looking for a home. It was super interesting to see MicroStrategy’s latest convertible bond offer had Allianz, the massive German insurer buy $500M of that. The times they are a changin’!

Public Company Adoption – It is almost a daily occurrence now to read of another public company going onto the Bitcoin Standard. On December 10th Microsoft shareholders will be voting to put Bitcoin on its balance sheet. Here is Michael Saylor’s 3 minute presentation to the Microsoft Board. I doubt they will vote yes because we are still so early but the fact that there is a vote on this is wild!

Nation State (Country) Adoption – it is looking certain that additional countries, beyond the OG El Salvador, will be adopting Bitcoin in 2025. In the USA alone, multiple states are set to adopt a Bitcoin Strategic Reserve, and perhaps it will also be adopted for the USA overall.

2025 will be wild as the Bitcoin Strategic Reserve “arms race” plays out!

Institutional Adoption – If you are an institutional investor, how long can you ignore the best performing asset of last 1, 5, 10, 15 years? Eventually their investors start to ask why “pros” missed the BEST investment of past decade. They are all coming now, en masse.

It’s hard for you and your family to do your Bigger Things when your time and energy is being stolen from you. Cross the bridge to a system that protects your wealth and gives you back your time…

Based on the confluence of factors listed above, it seems Bitcoin is an idea whose time has come. In the words of Hemingway “gradually, then suddenly”.

In 2025 I believe we will hit the “suddenly” part.

To Your Bigger Things!

Brad 💕👊

p.s. to be clear, I believe Bitcoin will eventually hit $1M per coin, like by the end of the decade.

You are receiving The Bigger Things Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial, accounting or legal advice. Do your own research, come to your own conclusions and make your own decisions.

Great post! Breaks down very clearly why everyone should have some part of their portfolio invested in Bitcoin.

The article "Time is Running Out" is such a powerful and timely piece! The way Brad breaks down the urgency of climate action is both eye-opening and motivating. I really appreciate how he has taken a complex issue and made it relatable and engaging—it’s not easy to do that, but as usual he's done a fantastic job. This article is a great reminder that we all have a role to play, and it’s written in a way that genuinely inspires me to action. Great work!